CA Trustee Property Petition 2014-2025 free printable template

Show details

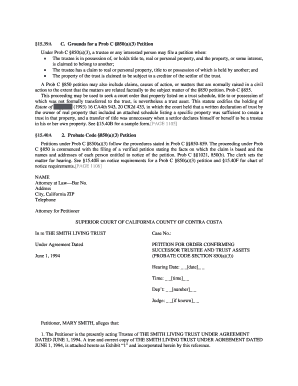

?15.39A C. Grounds for a Prob C ?850(a)(3) Petition Under Prob C ?850(a)(3), a trustee or any interested person may file a petition when: ? The trustee is in possession of, or holds title to, real

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Trustee Property Petition

Edit your CA Trustee Property Petition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Trustee Property Petition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA Trustee Property Petition online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA Trustee Property Petition. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out CA Trustee Property Petition

How to fill out CA Trustee Property Petition

01

Gather necessary documents such as the trust document and any property deeds.

02

Complete the CA Trustee Property Petition form carefully, ensuring all required sections are filled out.

03

Provide detailed information about the trust, including the names of the trustees and beneficiaries.

04

Include a description of the property in question and its value.

05

Attach any supporting documents that are required by the court.

06

File the completed petition with the appropriate California court.

07

Serve copies of the petition to all interested parties, including beneficiaries.

Who needs CA Trustee Property Petition?

01

Anyone who is a trustee of a trust and needs to transfer property held in that trust.

02

Beneficiaries seeking to have the trustee manage property in accordance with the trust's terms.

03

Individuals involved in the administration of a trust that includes real estate or other significant assets.

Fill

form

: Try Risk Free

People Also Ask about

What is a Heggstad petition for personal property?

Named after a California court case that created precedence, the Heggstad petition allows a claimant to file a petition if they can prove that a property or asset intended for inclusion in a Trust was excluded. If approved, this property is declared by the court to be a part of the Trust.

Who is entitled to notice of a Heggstad petition?

Notice of hearing would be required as provided in Probate Code section 1220 to each of the persons named in the petition, which includes each heir and devisee of the decedent, each person named as executor or alternate executor in the pour-over will, each beneficiary of the recipient trust that is identified in the

How long does a Heggstad petition take?

You can generally expect the Heggstad Petition process to be complete within 60 days, from the preparation and filing of the petition to the final decision by the judge. This process is much faster compared to a full probate, which can take years to complete and cost thousands of dollars.

How much notice is required for a Heggstad petition?

A Heggstad petition filed under Probate Code 850 requires 30 days notice to all interested parties. In some cases personal service is required so make sure your attorney knows exactly what the probate code requires because failure to follow the rules specifically will cause a Heggstad petition to fail.

How do I object to a Heggstad petition?

Any opposition to a Heggstad Petition in California should be served and filed at least nine (9) court days before the hearing unless the court has ordered otherwise. The opposition should be served by personal service or overnight mail under the provisions of Code of Civil Procedure section 1005.

Can a Heggstad petition be denied?

Yes, a Heggstad petition can get denied. Filing a Heggstad petition is not as simple as filling out a standard from. Instead, the petition must submit a number of documents and information to help prove that the disputed property was intended to be included in the Trust.

What do you need to show on a Heggstad 850 petition?

What information do I need to file a Heggstad petition? A copy of the decedent's Living Trust. The Living Trust's Schedule of Assets. The property deed. Information about the decedent, heirs, and beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is heggstad petition sample?

A Heggstad petition sample is a legal document used to request the court to transfer an asset into a living trust after the trustor's death, even if the asset was not specifically listed in the trust document. It is named after the California case of Estate of Heggstad, which established the legal basis for such petitions.

A sample Heggstad petition typically includes the following sections:

1. Caption: This includes the name of the court, the case number, and the parties involved in the petition.

2. Introduction: This section briefly explains the purpose of the petition and the background of the case.

3. Statement of Facts: This part provides a detailed description of the trust, its provisions, assets listed in the trust, and the specific asset(s) that are subject to the petition.

4. Legal Basis: This section presents the legal argument based on the Heggstad case and other relevant laws, explaining why the asset should be deemed part of the trust.

5. Prayer for Relief: This is the section where the petitioner requests the court to grant the petition and transfer the asset into the living trust.

6. Verification: The petition must be signed and verified by the petitioner, usually under penalty of perjury.

Please note that this is a general outline of a Heggstad petition, and the specific contents and formatting may vary depending on the jurisdiction and the circumstances of the case. It is advisable to consult an attorney or use an attorney-drafted template specific to the jurisdiction where the petition will be filed.

Who is required to file heggstad petition sample?

A Heggstad petition is typically filed by the executor or administrator of an estate or by the decedent's beneficiaries.

How to fill out heggstad petition sample?

To fill out a Heggstad petition sample, you should follow these steps:

1. Start by stating the full name of the petitioner at the top of the document. The petitioner is the person who is filing the petition.

2. Identify the court where the petition is being filed. Include the name of the county and the specific court division.

3. Write the case name and number. This information can be obtained from the court clerk or from any previous documentation related to the case.

4. Begin the body of the petition by stating the purpose of the petition. In this case, it is requesting the court to determine the existence of a Heggstad trust.

5. Provide a brief background of the situation. Explain that the decedent had a document, such as a pour-over will or a deed, indicating their intent to transfer a specific asset into a trust.

6. Include a description of the asset in question, such as real estate property or a bank account. Be sure to provide all relevant details, such as the address of the property or the account number.

7. Clearly state that the transfer of the asset to the trust was not completed before the decedent's death.

8. Make reference to Section 850 of the California Probate Code, as this is the legal basis for the Heggstad petition. Explain that this section allows the court to determine the decedent's intent and authorize the transfer.

9. Cite any supporting evidence, such as copies of the decedent's will or other relevant documents that demonstrate their intent to transfer the asset to the trust.

10. Conclude the petition by requesting that the court investigate and make a determination regarding the existence and validity of the Heggstad trust.

11. Provide space for the petitioner's signature, as well as their contact information including address, phone number, and email.

12. Add a similar space for the attorney, if applicable, to sign and include their contact information.

Remember, it is crucial to consult with an attorney or legal professional when filling out a Heggstad petition, as the sample provided here is merely a general guide and may not be applicable to your specific case or jurisdiction.

What is the purpose of heggstad petition sample?

A Heggstad petition sample is a legal document used in California to petition the court for a determination that certain property should be included in a trust, even though it was not formally transferred to the trust. The purpose of a Heggstad petition is to rectify any potential oversight or error in transferring property to a trust, thereby avoiding the need for probate. The sample petition serves as a template or guide for individuals or their legal representatives to use when drafting a Heggstad petition for their specific circumstances.

What information must be reported on heggstad petition sample?

The information that must typically be included in a Heggstad petition sample includes:

1. Case information: The name of the court, case number, and the name of the petitioner (the person filing the petition).

2. Caption: The caption typically includes the title of the case, such as "In the Matter of the Estate of [Decedent's Name]."

3. Introduction: An introductory paragraph identifying the purpose of the petition, which is usually to request that a particular asset be included as part of the decedent's trust.

4. Background and decedent information: A brief statement providing details about the decedent, their death, and their estate plan, such as whether they had a trust.

5. Asset description: A detailed description of the asset that the petitioner seeks to include in the trust, often including the property address, legal description, and any associated documentation.

6. Decedent's intent: A statement or argument explaining the decedent's intent or belief that the asset in question should be part of the trust, even if it was not explicitly mentioned in the trust document.

7. Legal basis: A section outlining the legal basis for the petitioner's claim, usually referencing relevant sections of probate code or case law that support the request.

8. Supporting evidence: Any supporting documents or evidence that bolster the petitioner's claim, such as copies of the decedent's will, trust agreement, or any other relevant documentation.

9. Prayer for relief: A statement requesting the court to grant the petitioner's request and include the asset in the trust.

10. Notice and service: A section describing the process and method of serving notice to interested parties, such as heirs, beneficiaries, or creditors, as required by the court rules.

It's important to note that the actual content and requirements of a Heggstad petition may vary depending on the jurisdiction and specific circumstances of the case. Therefore, consulting with an attorney or using an official court-provided form is recommended to ensure compliance with local rules.

How do I modify my CA Trustee Property Petition in Gmail?

CA Trustee Property Petition and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send CA Trustee Property Petition for eSignature?

Once your CA Trustee Property Petition is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out CA Trustee Property Petition using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign CA Trustee Property Petition and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is CA Trustee Property Petition?

A CA Trustee Property Petition is a legal document filed in California to obtain court approval for the management or distribution of property held in trust.

Who is required to file CA Trustee Property Petition?

The trustee of the trust or any interested party, such as beneficiaries, may be required to file a CA Trustee Property Petition when seeking court intervention regarding trust property.

How to fill out CA Trustee Property Petition?

To fill out a CA Trustee Property Petition, complete the required forms with accurate and detailed information about the trust, property, and the requested court action, then file them with the appropriate court.

What is the purpose of CA Trustee Property Petition?

The purpose of the CA Trustee Property Petition is to seek the court's guidance or approval for actions related to the trust property, ensuring compliance with legal obligations and protecting the interests of beneficiaries.

What information must be reported on CA Trustee Property Petition?

The information that must be reported includes the details of the trust, description of the property, the reason for the petition, and the specific relief or order sought from the court.

Fill out your CA Trustee Property Petition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Trustee Property Petition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.